Enterprise Zone Program

The Enterprise Zone program is a jobs incentive program that provides Louisiana income and franchise tax credits to a new or existing business located in Louisiana creating permanent net new full-time jobs. Click here more information

Quality Jobs Program

The Quality Jobs, or QJ, program provides a cash rebate to companies that create well-paid jobs and promote economic development. For more information please click here.

Industrial Tax Exemption Program

The Louisiana Industrial Ad Valorem Tax Exemption Program (ITEP) is an original state incentive program which offers an attractive tax incentive for manufacturers within the state. For further information please click here.

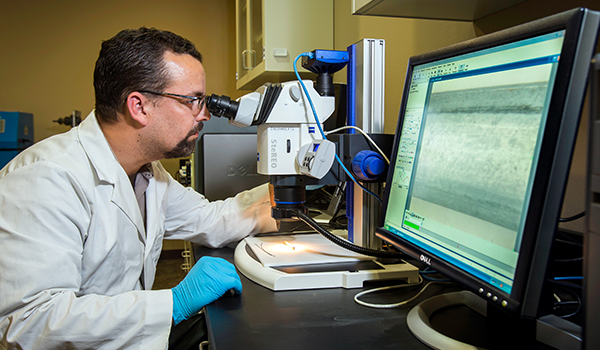

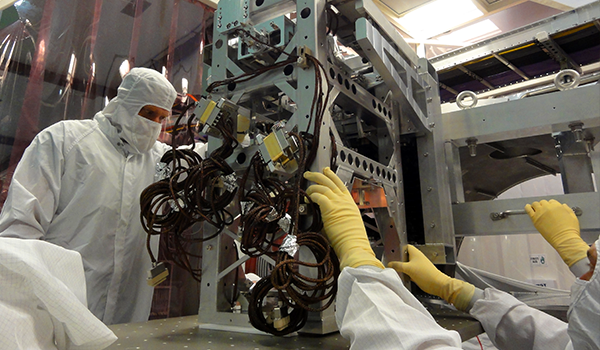

Research & Development Program

The Research and Development tax credit encourages existing businesses with operating facilities in Louisiana to establish or continue research and development activities within the state. Click here for more information

Louisiana FastStart

Louisiana FastStart provides customized employee recruitment, screening, training development and training delivery for eligible, new or expanding companies — at no cost. Click here for more information

Digital Media Program

Louisiana’s Digital Interactive Media and Software Development refundable tax credit is helping digital media and software development companies of all sizes gain a competitive edge. Please click here for more information on the program.

Incumbent Worker Training Program

The Incumbent Worker Training Program is designed to benefit business and industry by assisting in the skill development of existing employees through individual, standardized training. Click here for more information

Louisiana Contractors Accreditation Institute

The Louisiana Contractors Accreditation Institute, a partnership between LED, Louisiana Community & Technical College System and State Licensing Board offers information about construction management and how to prepare for the State Licensing Exam. Click here for more information.

Small Business Loan and Guaranty Program

The Small Business Loan and Guaranty Program facilitates capital accessibility for small businesses by providing loan guarantees to banks and other small business lenders in association with the federal State Small Business Credit Initiative (SSBCI). Click here for more information.

Veteran Initiative

Louisiana’s Veteran Initiative (LAVETBIZ) is a certification program designed to help eligible Louisiana Veteran-owned and Service-Connected Disabled-Veteran-owned small businesses gain greater access to purchasing and contracting opportunities that are available at the state government level. Click here for more information.

Small & Emerging Business Development Program

The program’s purpose is to provide financial assistance, which will help with the development, expansion and retention of Louisiana’s small businesses. The program is administered by LED through LEDC. For more information please click here.

Hudson Initiative

Louisiana’s Hudson Initiative is a certification program that is designed to help eligible Louisiana small businesses gain greater access to purchasing and contracting opportunities that are available at the State government level. For more information please click here.

Economic Gardening

Louisiana Economic Development’s Economic Gardening Initiative provides Louisiana-based small businesses with the information they need to grow and succeed. For more information please click here.

CEO Roundtables

Louisiana Economic Development’s CEO Roundtables bring together groups of 15 to 18 key decision makers from Louisiana-based small businesses 10 times over the course of a year for collaborative, growth-oriented roundtable sessions that support a trusting environment in which CEOs can safely explore business and personal issues with the guidance of experienced facilitators. For more information please click here.

Tax Structure

Louisiana has worked in recent years to shape a tax structure that supports business growth and is steadily rising in national business climate rankings. Detailed information on state taxes can be found through the Department of Revenue at www.revenue.louisiana.gov.

Ready to Become a Member?

The LEDC can do wonders for your company in Livingston Parish.

From location to transition and beyond, the LEDC stands ready to assist. If you have questions, please give us a call at (225) 686-3982 or if you are ready to get started, just click the button below!